The results confirm the high-grade, pure silver character of the mineralization and reinforce the need for systematic exploration outside of the existing resource

Vancouver, BC – August 18, 2025 – Global Stocks News – Sponsored content disseminated on behalf of Argenta Silver. On August 13, 2025, Argenta Silver (TSXV: AGAG) (OTCQB: AGAGF) (FSE: T1K) released a 2nd batch of assay results from its ongoing 2025 winter diamond drilling program at the 100% owned El Quevar Project in Salta Province, Argentina.

Argenta Silver is a young company (8 months old) helmed by a young CEO, Joaquín Marias (37 years old). Youthful leadership with strong geological credentials, backed by high-level strategic advisers (Frank Giustra & Eduardo Elsztain) has been well received by the market. Year-to-date, Argenta’s share price has risen 300% from .21 to .63.

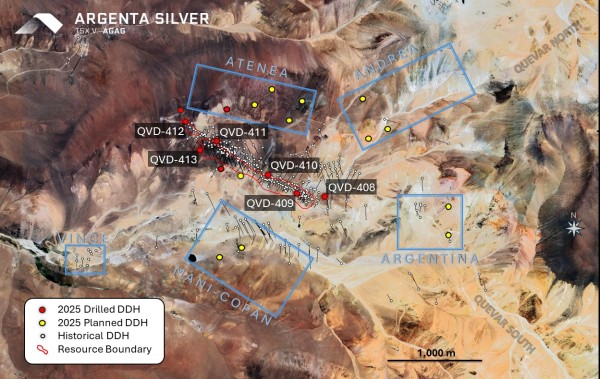

The El Quevar Project spans an area of 57,000 hectares – equivalent to a square with sides 15-miles-long. Less than 3% of the land package has been comprehensively explored. The property has 60 kilometers of internal roads, a fully operational camp for 100 workers, with a railroad, gas pipeline and a service road three kilometers from camp.

The 2025 4,000-meter winter drilling is approximately 15% confirmation drilling, 25% expansion drilling and 60% exploration drilling. Argenta believes that the Yaxtché deposit is still open.

On August 14, 2025 6ix Inc. hosted a webinar with CEO Joaquin Marias to discuss the latest drill results and the long-term value creation strategy at Argenta. The event, moderated by 6ix VP Business Solutions, Romeo Maione, was published on YouTube.

“There is no gold, no lead, no zinc, no copper in these analytical results,” Marias told Maione. “It’s a pure silver play, which is rare and precious. Confirmation drill holes help us to understand the technicalities of the resource. The step-out drill hole is telling us that the resource might continue.”

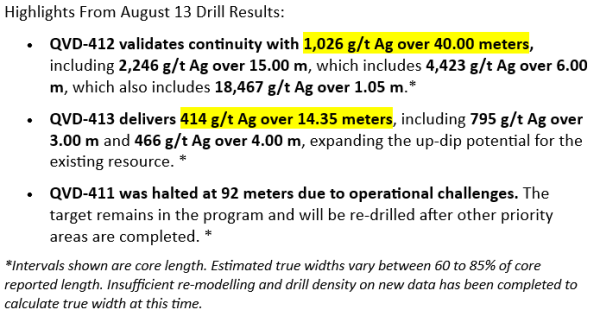

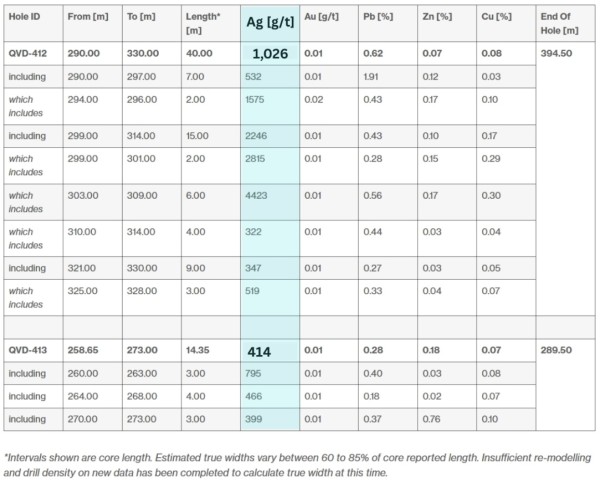

“The success of the up-dip hole QVD-413, along with the project’s highest-ever assay, 18,467 g/t silver over 1.05 meters within a broader interval of 1,026 g/t silver over 40.00 meters in QVD-412, validates and reinforces our dual strategy,” stated Marias in the August 13 press release, “Expanding the known resource while aggressively exploring the vast, untested areas of this high-grade system.”

“From a technical standpoint,” continued Marias, “the extraordinary tenor of the Yaxtché mineralization highlights the strength and scale of the hydrothermal system that formed El Quevar.”

Alongside previously disclosed drillholes from this program (see news release from July 21, 2025), the results also confirm the high-grade, pure silver character of the mineralization and reinforce the need for systematic exploration outside of the existing resource (Yaxtché deposit) when less than 3% of the property has seen modern exploration.

On August 12, 2025 Argenta Silver announced that it had raised CND $15 million at a price of C$0.40 per unit. Pursuant to the offering, Frank Giustra acquired 450,000 common shares and 225,000 Warrants.

Mr. Giustra’s ownership position in Argenta now represents 15.09% of the outstanding common shares and 16.78% on a partially diluted basis, assuming the exercise of 3,425,000 warrants.

On August 12, 2025 Argenta also announced the closing of an investment of CND $2.5 million by Tyrus S.A., an affiliate of Mr. Eduardo Elsztain, on the same terms as the investor rights agreement dated April 28, 2025.

Elsztain is Argentina’s largest real-estate developer through IRSA, which owns 15 shopping centers and numerous hotels and resorts. Elsztain is also a key stakeholder in the agriculture company, Crescud, producing cattle, soybeans, wheat, corn and sunflowers on 800,00 hectares of farmland.

“Mr. Elsztain is a very influential businessman in Argentina,” Marias confirmed to Guy Bennett, CEO of Global Stocks News (GSN). “He understands the mining industry. It’s part of our strategy to attract long-term, high-quality, well-connected strategic investors. We are grateful for Mr. Elsztain’s ongoing support.”

Mr. Elsztain, through IFIS Ltd. and Tyrus S.A., owns and/or controls directly or indirectly 31,250,000 common shares of Argenta, and 8,325,000 warrants, representing 12.57% of the outstanding Common Shares and 15.40% on a partially diluted basis.

Elsztain maintains a close relationship with Argentina’s President Javier Milei. During the 2023 election campaign, Milei set up his base of operations at the Libertador hotel, owned by IRSA.

The El Quevar project was purchased for USD3.5 million in October, 2024 after the previous operator sold numerous assets to resolve “urgent liquidity problems.

Drilling kicked off in late May as part of a fully funded 4,000-meter winter campaign designed to confirm known high-grade zones, step out along strike, and test new targets. [editor’s note: Argentina is in the Southern Hemisphere: the “winter drill program” occurs during Canada’s summer]

Assays from the first group of results were announced on July 21, 2025 (see news release from July 21, 2025). The exploration program is still on going and results for the remaining holes are expected by early and late September.

Rob van Egmond, P.Geo., a “qualified person” as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this release. Rob van Egmond, P.Geo. has visited the El Quevar Project and is not independent of the Company.

The foundational Mineral Resource Estimate of the Yaxtché deposit boasts an indicated mineral resource of 45.3 million ounces of silver from 2.93 million tonnes grading 482 g/t Ag, and an inferred resource of 4.1 million ounces from 0.31 million tonnes grading 417 g/t Ag [1.]

[1.] Refer to NI43-101 technical report with effective date of September 30, 2024, titled “NI 43-101 Technical Report on the Mineral Resource Estimate of the El Quevar Project Salta Province, Argentina”, posted on www.SEDAR.com under Argenta Silver Corp.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Argenta Silver paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:32513

The post Argenta Silver Validates Deposit Continuity and Expands Known Resource with High Grade Silver Intercepts appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Diligent Reader journalist was involved in the writing and production of this article.